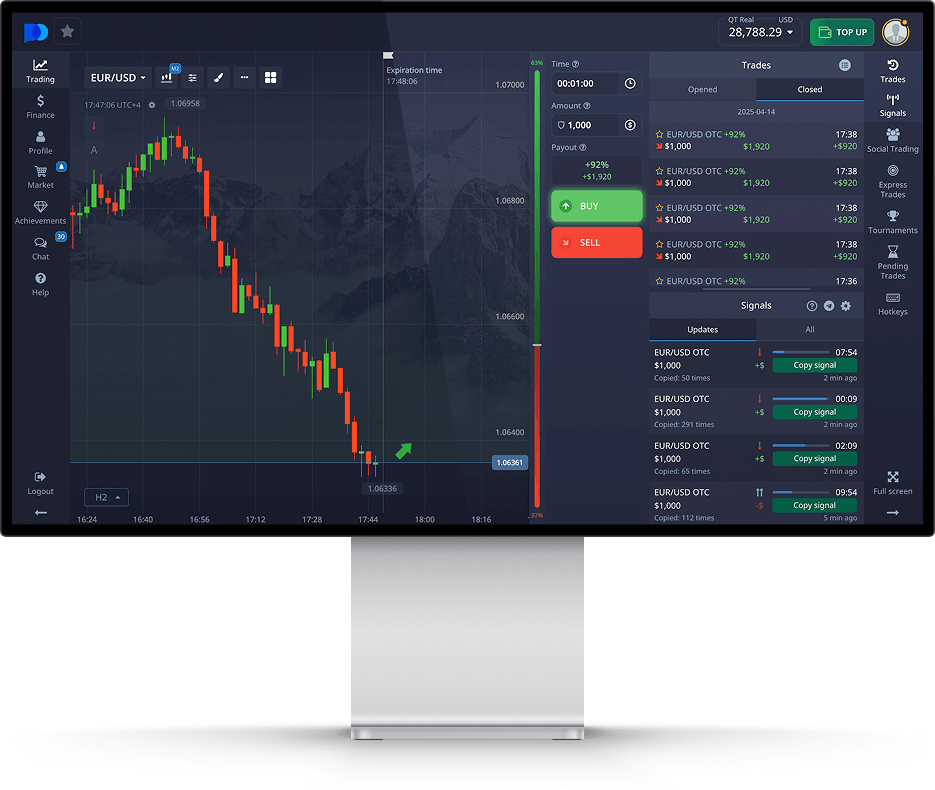

In the world of online trading, platforms like trading strategies pocket option Pocket Option RU have become a beacon for traders looking to capitalize on digital assets. With a myriad of trading strategies available, it can be overwhelming to determine which one is the most effective. In this comprehensive guide, we will explore various strategies that can enhance your trading experience on Pocket Option and increase your chances of success.

Understanding the Basics of Trading Strategies

Before delving into specific strategies, it’s crucial to grasp the fundamental concepts of trading strategies in general. A trading strategy is a systematic approach that guides your trading decisions. It typically includes criteria for entering and exiting trades, risk management protocols, and an analysis of market conditions. The effectiveness of a trading strategy hinges on its ability to adapt to the ever-changing market environment.

1. Trend Following Strategy

The trend-following strategy is one of the most widely used approaches in trading. It operates on the premise that prices tend to move in the same direction for a period of time. Traders using this strategy will identify whether a market is in an uptrend or downtrend and make trades that align with the prevailing direction. On Pocket Option, you can utilize various technical indicators such as Moving Averages and the Relative Strength Index (RSI) to ascertain trends.

How to Implement Trend Following

- Identify the trend using a longer time frame chart.

- Wait for a pullback and enter a trade in the direction of the trend.

- Set stop-loss orders to manage risk effectively.

- Consider taking profits at pre-determined levels based on resistance or support lines.

2. Scalping Strategy

Scalping is a short-term trading strategy that aims to profit from small price moves. In this strategy, traders make numerous trades throughout the day, holding positions for a few seconds to several minutes. The goal is to “scalp” small profits consistently. This method requires a disciplined approach and an excellent understanding of market volatility.

Scalping Tips for Pocket Option

- Select currency pairs with high volatility for better price movements.

- Use shorter time frames (1-minute or 5-minutes) for analysis.

- Employ tight stop-loss orders to minimize potential losses.

- Be prepared to make quick decisions and execute trades swiftly.

3. News Trading Strategy

News trading capitalizes on market movements generated by economic announcements and news events. Traders need to keep a close eye on the economic calendar to identify these events, as they can cause significant volatility in the market. This strategy often requires a solid understanding of how news impacts currency prices and which events to prioritize.

How to Trade on News Events

- Identify major economic events such as interest rate decisions or employment reports.

- Analyze market sentiment before the news is released.

- Be ready to execute trades immediately after the announcement, as markets can react rapidly.

- Manage risk carefully by using stop-loss orders to protect your capital.

4. Reversal Trading Strategy

The reversal trading strategy focuses on identifying potential turning points in the market, where a price trend may change direction. This strategy is based on the belief that markets are cyclical, and overextended trends will eventually revert back. Implementing this strategy requires a keen eye for technical indicators and an understanding of market psychology.

Implementing a Reversal Strategy

- Look for overbought or oversold conditions using tools like RSI or Stochastic Oscillator.

- Monitor candlestick patterns for signs of reversal (e.g., pin bars, engulfing patterns).

- Enter trades only when confirmation of reversal is present.

- Utilize stop-loss orders to limit losses if the trade does not go as planned.

5. Risk Management Strategies

No trading strategy is complete without an effective risk management plan. Proper risk management can mean the difference between successful trading and significant losses. Traders should always aim to protect their capital while maximizing potential gains.

Essential Risk Management Techniques

- Determine how much of your total capital you are willing to risk on a single trade (commonly 1-2%).

- Use stop-loss orders to minimize potential losses.

- Regularly review and adjust your risk management strategy as needed.

- Keep a trading journal to review your trades and learn from mistakes.

Conclusion

To excel in trading on Pocket Option, it is essential to choose a strategy that aligns with your trading style and risk tolerance. Whether you prefer trend following, scalping, or trading based on news events, make sure to incorporate solid risk management practices. Remember that successful trading is not just about understanding strategies but also developing the discipline and mindset to execute them effectively.

By continually educating yourself, practicing your strategies, and adapting to changing market conditions, you can enhance your trading abilities and potentially see greater success on the Pocket Option platform. Happy trading!